non resident tax malaysia

Payments for services in connection with the use of property or installation. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

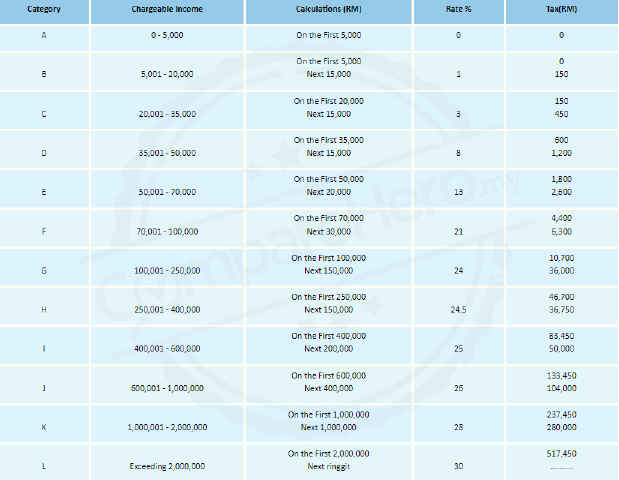

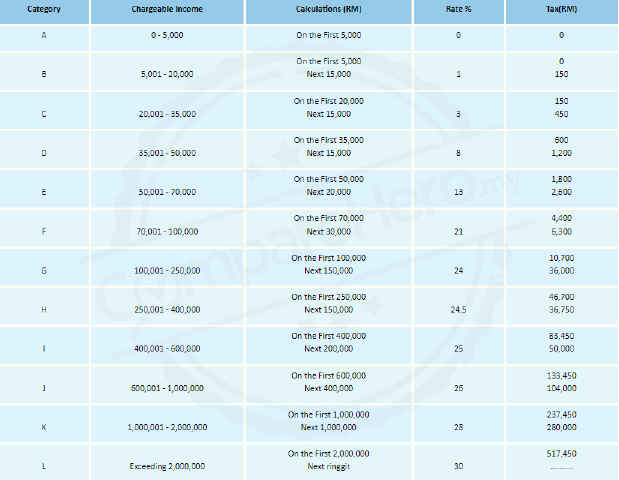

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Assuming youre a local tax resident youll.

. Non-resident companies are liable to Malaysian tax when it carries on a business through a permanent establishment in Malaysia and assessable on income accruing in or derived from. Individuals corporates and others will continue to be exempted from income tax under Paragraph 28 Schedule 6 of the Malaysian Income Tax Act. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Non-resident individual is taxed at a different tax rate on income earned received from Malaysia. With the introduction of the single tier dividend system effective 112008 all dividends are tax free. The maximum tax rate is 30 percent 1.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Determination of Residence Status of Companies Management and control is. In Malaysia the principal difference between a resident and non-resident is that the non-residence is taxed at a rate of 30 without being eligible to enjoy any tax reliefsrebates whereas a.

Income earned by residents are subjected to a scaled income tax rates from 0 to 28. The Malaysian government considers expatriates working in the country for more than 60 days but less than 182 days as non-residents and subjects them to a flat taxation rate. Flat rate on all taxable income.

2020 income tax rates for residents Non-residents are subject to withholding taxes on certain types of income. So how does the Malaysian non-resident tax rate compare with the tax rate for residents. The status of individuals as residents or non-residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Residents are subject to a sliding scale of income tax. Malaysian tax rates for residents.

Malaysian tax residents - what income is taxable. Non-resident individual is taxed at a different tax. Whereas for non-residents income earned would be subjected to a flat tax rate of 28.

Non-Resident means other than a resident in Malaysia by virtue of section 8 and subsection 61 3 of the ITA. The non-resident tax rate in Malaysia is a flat rate of 30 on all taxable income². 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Foreigners who qualify as tax-residents follow the same tax. You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Types Rates of Payments 1 Contract Payments to non-resident Contractors payee 10 tax rate is implemented on the service portion as the tax payable by the payee 3 tax rate is. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. A non-tax-resident individual would be taxed at a flat rate of 30 percent.

If taxable you are required to fill in M Form. However if you claimed RM13500 in tax. Other income is taxed at a rate of 30.

Non-tax-residents are not entitled to personal relief deductions. Non-resident taxpayers ie. Malaysia Non-Residents Income Tax Tables in 2020.

Healy Consultants Favourite Offshore Jurisdictions 2015 Offshore Business Infographic Consulting

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

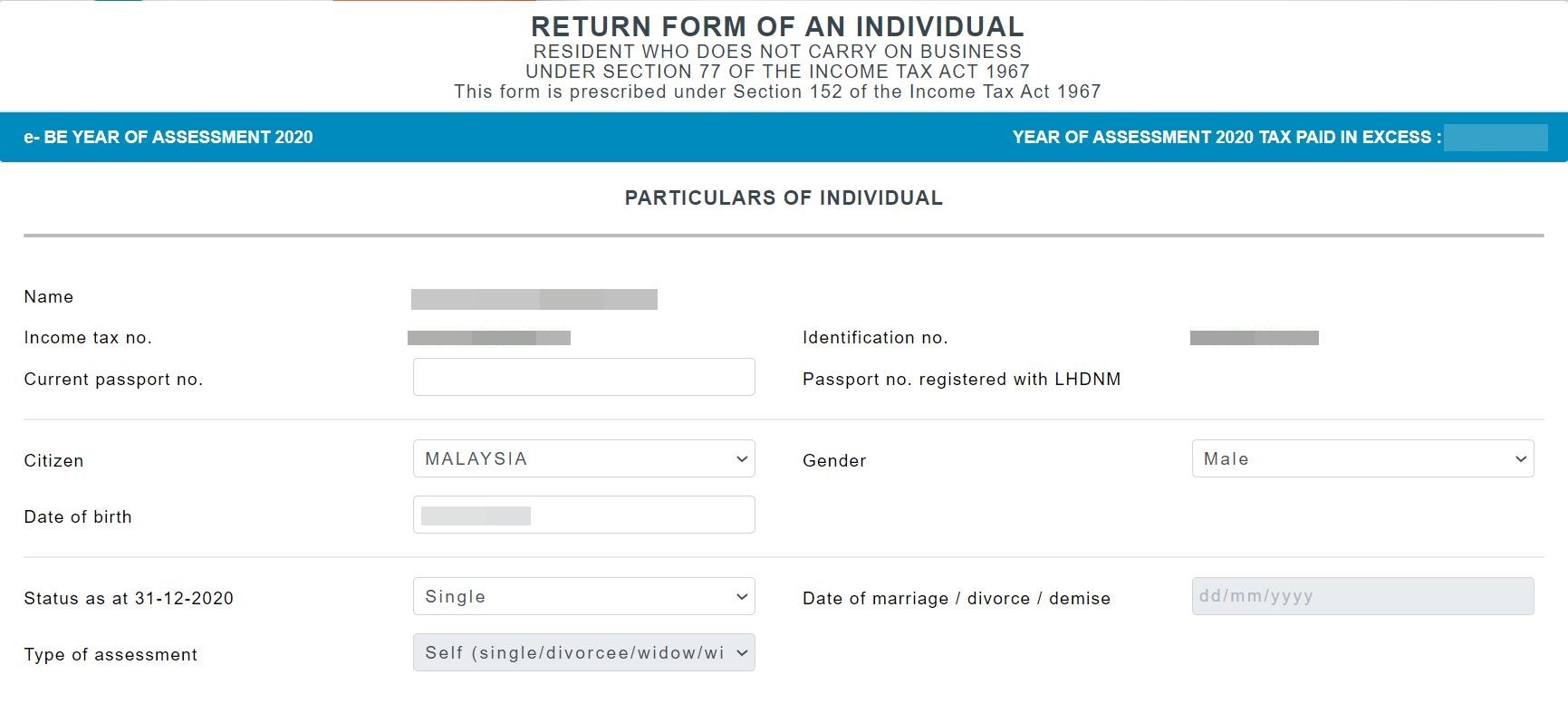

Malaysia Personal Income Tax Guide 2021 Ya 2020

Mwka Online Talk Am I A Tax Resident In Malaysia

Personal Income Tax Guide For Expatriates Working In Malaysia 2022

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

Waterfalls Of Malaysia Waterfall Malaysia Best

Income Tax Malaysia 2022 Who Pays And How Much

Difference Between Nri And Pio Citizen Finance Different Personal Finance

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

Pros And Cons Of Starting A Business In Malaysia S F Group Malaysia Starting A Business Business Visa

Socso Social Security Organization Iperkeso Social Security Social Organization

Individual Income Tax In Malaysia For Expats Gpa

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Software Tax

Individual Income Tax In Malaysia For Expatriates

Difference Between Wire Transfer Swift And Ach Automated Clearing House First Time Home Buyers Buying Your First Home Finance Loans

Comments

Post a Comment